How much money is the lack of not understanding money costing you? In 2022, the average cost of not understanding money cost adults $1,819 that year. It may not seem like a lot, but if you take that amount every year and compound it with the average return of the stock market for a 30-year period, it would cost you over $300,000! Your money is going to make someone rich, it may as well be you. Get the financial education you should have received in high school for free!

BECOMING A MEMBER FOR FREE

DOWNLOAD MY MONEY & LEGACY F.I.T. (FINANCIAL INDEPENDENCE TRACKER) & ORGANIZER FOR FREE

A Membership That Will Improve Your

Financial Journey Throughout Your Life

-

Learn how to go from negative to positive cash flow each month without difficult budgeting.

-

Learn different leverage strategies to build wealth for your family.

-

Finally, build your confidence around investing and building wealth.

-

Master Money EQ (emotional intelligence) to build your investor persona.

-

Grasp the concepts of how you can use life insurance strategies to build long-term unbroken wealth and create cash-flow banking for your family or business.

-

Discover the higher laws of money and the missing piece in legacy and much more.

FINANCIAL EDUCATION

Without the proper financial education, you will constantly struggle with money, no matter how much you make. Financial education is more than just understanding the basics like compound interest, the rule of 72, the time value of money, stocks, bonds, cash flow & debt management, and life insurance, etc.

Financial education is about becoming aware of what money truly is, not only on an intellectual level, but on an intuitive level as well. It's about you learning and implementing that knowledge so you can become a financial wizard throughout your life.

Everything Is Better When You Know How Money Works!

-

Better Financial Decisions

When difficult financial questions and choices come along, having the proper financial education increases the financial opportunities and choices you can make for yourself and your family. You will go from limited to limitless!

-

Better Quality of Life

It's true that the more you increase your financial education, you increase your chances of living a better quality of life. Implementing simple cash flow and leverage strategies will make a huge difference in the quality of lifestyle for you and your family.

-

Better Chance of Building Wealth

Working for money isn't the way to wealth. Increasing your financial education along with clear, concise, and speedy implementation of what you learn will be the determining factor to how wealthy you become.

-

Better Retirement

Not having the proper education on where, when, and how much to invest can be the difference between a glorious retirement and a retirement depending on family, friends, and the government. The proper education will allow you to travel the world and focus on the people that truly matter in the end.

-

Better Relationships

When you learn how to master the energy of money, you'll begin to master the energy of time so you can utilize your energy to build more meaningful relationships.

-

Better Legacy

Generational wealth works the same way that generational poverty works. The lack of a financial education in your family destroys the chances of your financial legacy increasing over time. Build a greater financial legacy with the proper education and implementation.

The difference between the finances you have today and the finances you have tomorrow, will depend on the level of education you invest in today and how quickly and consistently you implement that education over the course of time.

ABOUT

I can give you a whole bunch of titles and accolades on why you should work with me and how my team and I can help you gain a greater understanding of your money and legacy, but what's the point? Isn't that normally what people do?

Well, the truth is, I'm a guy who didn't "figure it out" until later on in life. Like most people, I completely sucked at money and my idea of legacy was old pictures in a photo album of deceased relatives.

I started my entrepreneurial journey in 1995 when I unconsciously created a 6-figure business but failed 2 years later because of my lack of business and financial acumen. I didn't truly start learning about money until 2012. That is when I joined a personal financial success company to learn about investing, cash flow and debt management, and business and tax strategies.

In 2015, I became a licensed financial professional. This is when I not only taught people about money and legacy, it's when I started helping them implement various investment, cash flow, debt, retirement, life insurance, and legacy transfer strategies.

My Money and Legacy was created to further educate the masses and help them finally learn how to stress less over money and become a legacy creator for their family and generations to come.

EDUCATING THE MASSES IN THE ATLANTA AREA ON FINANCES ON THE PORTIA BRUNER SHOW ON FOX 5

Growing up, being raised by a single mom living in low-income housing (the projects), has inspired me to teach money, legacy, entrepreneurship, and life principles to help eradicate the poverty mindset in those communities. Imagine the opportunity of being exposed to the right financial education in the early stages of our lives. We learn money from our environment. Our environment is inclusive of all of society; parents, family, friends, peers, religious organizations, the media, and the communities we live in. It's important to understand that how our environment deals with money from the belief system, thoughts, feelings, and actions have a programming effect on how we deal with money.

I've had the privilege of training lots of financial professionals to help with the eradication of the poverty mindset that plagues most people when it comes to money and legacy. It's a war on economics and most people are losing due to the fact that they are fighting against the wrong enemy. The true enemy of our financial success is within us. Many of us blame our parents, society, communities, our boss, and even our children because of our financial situations.

Here are just a few examples of the things that people say to limit them from taking responsibility over their financial situation:

✅ My parents never taught me about money.

✅ Society didn't teach us about money.

✅ My boss won't give me a raise.

✅ I can't work more hours or start my business because I have kids.

It's time to find out what you can be, do, or achieve financially. It's time to activate your Big Power!

I am here to empower you to take back control over your life and to erase the limiting beliefs that stops you from living a more fulfilled and happier life financially. This is why it's not only important to understand how money and legacy work, it's also important to reprogram your financial DNA to change the trajectory of your family financially. Our membership is not only for you to learn money and legacy strategies for you to implement in your life, it's also to teach you the higher laws of money and the missing piece of legacy.

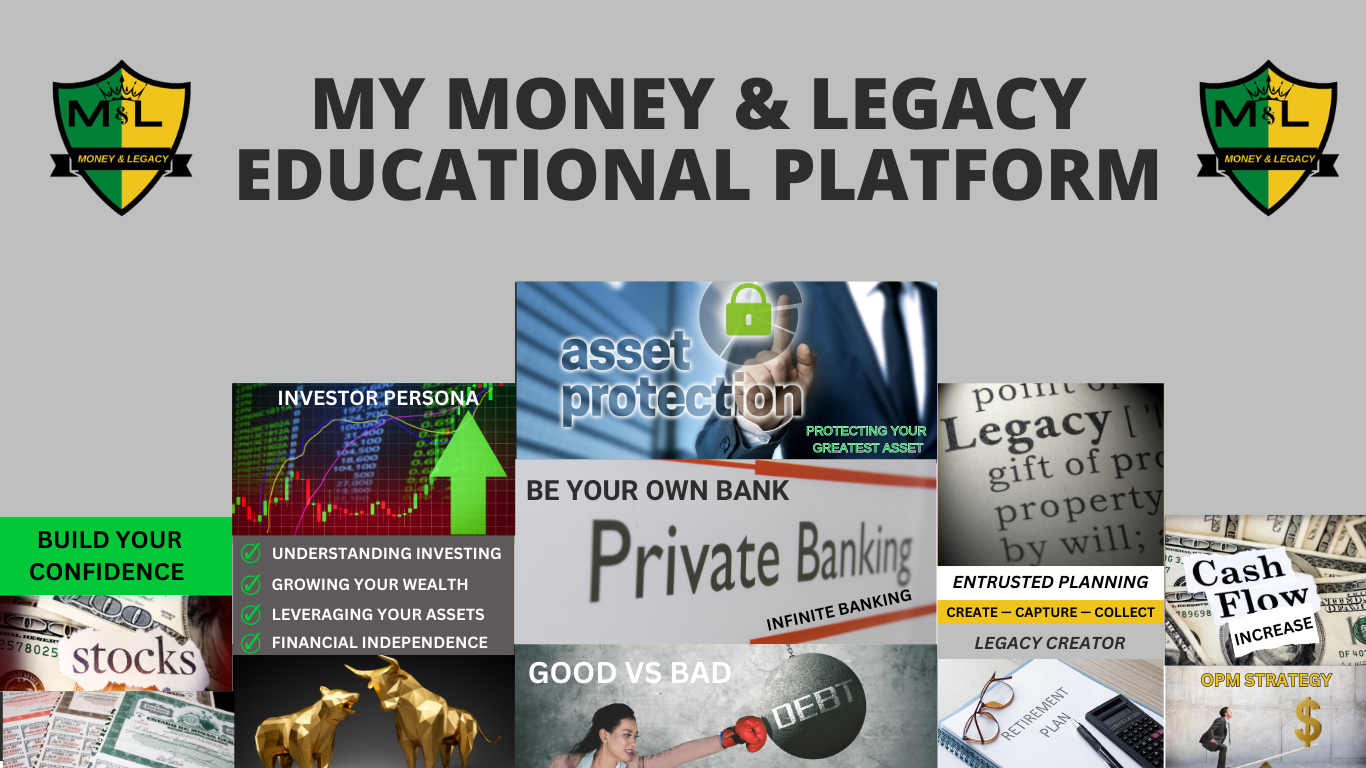

BENEFITS OF FREE MEMBERSHIP

-

BUILD YOUR CONFIDENCE IN INVESTING

-

INCREASE POSITIVE CASH FLOW & REDUCE BAD DEBT

-

MAXIMIZE USING OPM (OTHER PEOPLE'S MONEY) STRATEGIES TO BUILD WEALTH

-

BECOME A LEGACY CREATOR FOR YOUR FAMILY'S FUTURE GENERATIONS

-

LEARN TO LEVERAGE LIFE INSURANCE STRATEGIES TO CREATE YOUR FAMILY BANK

What Some Are Saying About Dre Parker

"It's been a privilege working with an exceptional coach like Dre. He crafted a personalized plan, explaining intricate concepts with clarity and patience. His proactive approach and clear communication style empowers me in my financial decisions.

"Andre Parker is my financial professional, and I am so grateful. Working with him has been a blessing, as he is more interested in what's best for me financially than what is going to garner the most profit for himself. Andre is concerned with the whole client, regardless of the amount of money they have. Lastly, while he is professional at all times, he is personal and intentional in his business dealings. I believe that he is God sent. "

"I've known Dre Parker for over 3 years now and he has been an instrumental part of my personal development. He always challenges me to go deeper with myself and provides great insight on looking at the cup as half full instead of half empty. He is well versed in Personal Development and Financial Literacy, which is beneficial for anyone he comes in contact with. Whenever I speak with Dre he gives tons of value and I don't think he realizes it sometimes lol. I admire how he has a calming demeanor despite the situation he's facing. I also love that he's an honest person with integrity."

Since I started working with Andre, he's always been extremely helpful, knowledgeable, and professional. He always made sure I understood my finances and made sure all my questions were answered quickly and efficiently. Though I appreciate his professionalism, I'm more grateful for his caring nature and the way he treats his clients with the upmost respect, which makes me feel I'm important to him.

BEGIN YOUR JOURNEY TO FINANCIAL INDEPENDENCE TODAY

100% Privacy. We Will Never Spam You!

MY MONEY & LEGACY EDUCATIONAL PLATFORM

My Money & Legacy Free Educational Platform is informational & educational only. No recommendations or advice are given here. For any tax, legal, or investment recommendations, you must speak to your licensed professional.

DISCLAIMERS

DISCLAIMER: The views expressed herein are exclusively those of Andre L. Parker and do not reflect the policy or position of GVCA. The content is not meant as investment advice and are subject to change. No part of this report may be reproduced in any manner without the express written permission of Andre L. Parker. Information contained herein is derived from sources we believe to be reliable, however, we do not represent that this information is complete or accurate and it should not be relied upon as such. All opinions expressed herein are subject to change without notice. This information is prepared for general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. You should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. You should note that security values may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not a guide to future performance.

The views expressed on this website are my personal views. They do not represent (nor are they intended to represent) the positions, opinions or policies of Global View Capital Advisors, LLC. (GVCA) or any of its affiliates..

© Copyrights by Askim Financial & Legacy Group LLC All Rights Reserved.

Askim Financial & Legacy Group LLC 2296 Henderson Mill Rd NE, #116 Atlanta, Georgia 30345